fidelity california tax free bond fund

For the fiscal year ending February 28 2022 the fund returned -166 roughly in line net of fees with the -162 result of the state-specific index the Bloomberg California Enhanced Municipal 1-7 Year Non-AMT Index. Ad Learn more about the VanEck family of Municipal Funds.

2021 Tax Information Center Homepage Fidelity Institutional

The fund lagged the -066 return of the benchmark the Bloomberg Municipal Bond Index and also trailed its Lipper peer.

. Normally not investing in municipal securities whose interest is subject to federal alternative minimum tax. FCSTX Fidelity CA Limited Term Tax-Free Bond Fund Class Information. The fund lagged the -066 return of the benchmark.

A number of funds have earned 4- and 5-star ratings. Find the latest Fidelity California Ltd Trm Tax-Free Bd FCSTX. Fidelity California Limited Term Tax-Free Bond Fund FCSTX No Transaction Fee 1 Hypothetical Growth of 1000023 6302012-6302022 n Fidelity California Limited Term Tax-Free Bond Fund 11222 n Muni Single State Short 10958 The performance data featured represents past performance which is no guarantee of future results.

Normally maintaining a dollar-weighted average maturity between. Learn more about the VanEck family of Municipal ETFs. Semi-Annual Report Note to Shareholders 3 Investment Summary 4 Schedule of Investments 5.

The fund normally invests at. Find the latest Fidelity California Limited Term Tax-Free Bond Fund FCSTX stock quote history news and other vital information to help you with your stock trading and investing. Fidelity California Limited Term Tax-Free Bond Fund is a single-state-focused municipal bond strategy investing in general obligation and revenue-backed municipal securities across the short-intermediate part of the yield curve.

Fidelity California Limited Term Tax-Free Bond Fund FCSTX Mutual. Our funds have star power. 403b 457b Participants Employees of Non-Profits Account balances investment options contributions tools and guidance.

Fidelity Tax-Free Bond Fund Semi-Annual Report July 31 2021. Bloomberg California 1-7 Year Non-AMT Enhanced Municipal Bond Index is a market value-weighted index of California investment-grade fixed-rate non-Alternative Minimum Tax AMT municipal bonds with maturities between 1 and 7 years. Analyze the Fund Fidelity California Limited Term Tax-Free Bond Fund having Symbol FCSTX for type mutual-funds and perform research on other mutual funds.

Fidelity California Limited Term Tax-Free Bond Fund. Stay up to date with the current NAV star rating asset allocation. Normally investing at least 80 of assets in investment-grade municipal debt securities whose interest is exempt from federal and California personal income taxes.

Fidelity Tax-Free Bond Fund. Explore Our Range of Tax-Exempt Bond Funds and Models. Ad Seek More From Municipal Bond Funds.

FCSTX A complete Fidelity California Limited Term Tax-Free Bond Fund mutual fund overview by MarketWatch. Analyze the Fund Fidelity California Limited Term Tax-Free Bond Fund having Symbol FCSTX for type mutual-funds and perform research on other mutual funds. Monthly Fact Sheet PDF Prospectus.

The investment seeks a high level of current income exempt from federal and California personal income taxes. FIDELITY CALIFORNIA LIMITED TERM TAX-FREE BOND FUND- Performance charts including intraday historical charts and prices and keydata. Fidelity CA Short-Int TaxFree Bond.

Ad Explore funds and choose those that align with your clients goals. FCSTX Mutual Fund Guide Performance Holdings Expenses Fees Distributions and More. View the latest Fidelity California Limited Term Tax-Free Bond Fund FCSTX stock price news historical charts analyst ratings and financial information from WSJ.

The fund seeks to provide consistent with prudent portfolio management the highest level of income exempt from federal and California state income taxes by investing primarily in investment-grade California municipal bonds. Fidelity California Limited Term Tax-Free Bond Fund FCSTX Mutual Fund Profile USA overview and fund description. Fidelity California Limited Term Tax-Free Bond Fund Key Takeaways For the fiscal year ending February 28 2022 the fund returned -166 roughly in line net of fees with the -162 result of the state-specific index the Bloomberg California Enhanced Municipal 1-7 Year Non-AMT Index.

Actual after-tax returns depend on your tax situation and are not relevant if you hold shares through tax-deferred arrangements such as IRAs or 401 k plans. No Transaction Fee 1. Fidelity California Limited Term Tax-Free Bond Fund Fidelity California Limited Term Tax-Free Bond Fund FCSTX.

View mutual fund news mutual fund market and mutual fund interest rates. That composite rate consists of a fixed rate which is currently 0 on new bonds and an. Even with interest rates on savings accounts and certificates of deposit crawling up in the wake of the Federal Reserves interest rate hikes the 962 composite rate on newly issued Series I savings bonds is hard to ignore.

525 12133 35000 35134 55 4130 5000 5020 Series 2012 525 4135 2920000 3017908. 401k Participants. XNAS quote with Morningstars data and independent analysis.

See Franklin California Tax Free Income Fund performance holdings fees risk and other data from Morningstar SP and others. Learn About The Tax-Exempt Bond Fund of America. Our Curated Customizable Education Resources Can Help You Become a Smarter Investor.

Can You Lose Money In An Annuity The Surprising Truth 2022

/taxescoins_367927862-5bfc32ecc9e77c0051812397.jpg)

How Can I Find Tax Exempt Mutual Funds

Personal Capital Versus Fidelity Go Comparison Financial Samurai Retirement Planner Financial Advice Wealth Management

Motley Fool Mutual Funds Aren T Taxed Twice

The 4 Types Of Annuities Which Is Right For You Thrivent

Tax Information Center 2020 Fund Data And Rates Table Fidelity Institutional

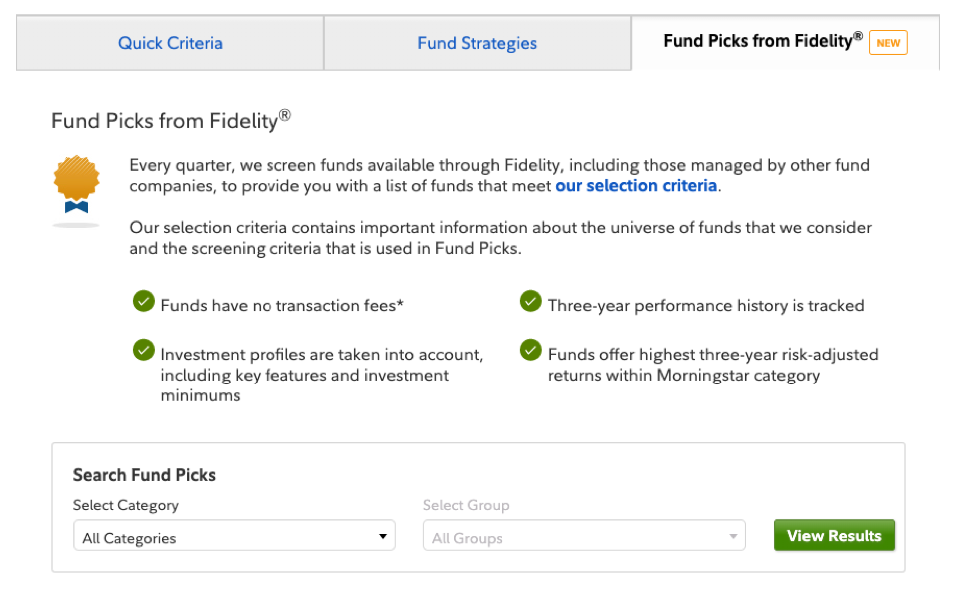

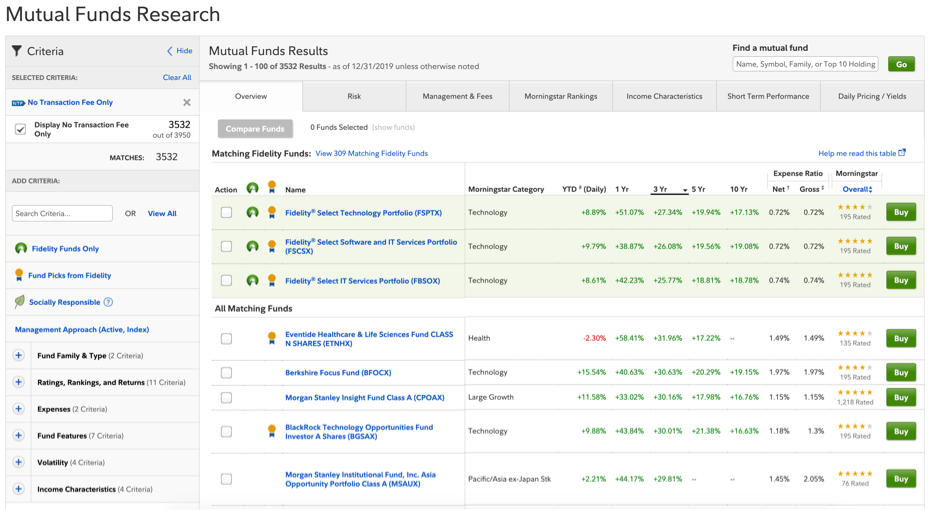

Stock Screeners Fund Comparison Tools From Fidelity

Stock Screeners Fund Comparison Tools From Fidelity

How To Decide Whether To Spend Or Save Your Tax Refund

5 Best Index Funds With Low Expense Ratios Nextadvisor With Time

2021 Tax Information Center Homepage Fidelity Institutional

2021 Tax Information Center Homepage Fidelity Institutional

Wash Sale Rules How To Avoid Pricey Tax Consequences Nerdwallet

Switching Online Brokers Here S How To Move Your Investments To A New Account Bankrate

How To Buy Municipal Bonds Ally

Cfbax Climate Focused Bond Fund Class A Lord Abbett

How To Invest In Wine Forbes Advisor

When You Need Cash Reserves To Get A Mortgage Bankrate

![]()

Personal Capital Versus Fidelity Go Comparison Financial Samurai Retirement Planner Financial Advice Wealth Management